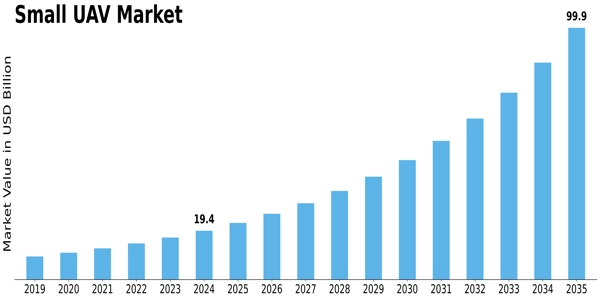

The global market for small unmanned aerial vehicles (UAVs) is on a steep upward trajectory. According to data from Market Research Future, the industry was valued at USD 19.45 billion in 2024 and is expected to reach USD 100.11 billion by 2035, growing at a CAGR around 16%.

Market Outlook

This growth is driven by a combination of technological enhancements — such as improved battery endurance, advanced sensors, AI-based navigation — and expanding use-cases in civilian/commercial as well as defense sectors. The delivery of goods via drones, precision agriculture, and enhanced border surveillance are among the standout applications. Nevertheless, issues such as airspace integration, security risks and standardisation continue to cast shadows.

Industry Overview

The small UAV sector is characterised by its agility and adaptability. These drones, smaller than traditional unmanned aerial vehicles, can access tight spaces, require lower infrastructure investment and enable new operational models. Industries from farming to infrastructure inspection to law-enforcement are rapidly adopting them. As regulatory regimes evolve, these platforms are increasingly shifting from pilot projects to mainstream deployment.

Key Players

Major international players actively shaping the market include Lockheed Martin, BAE Systems, AeroVironment Inc., DJI, Elbit Systems Ltd., and SAAB. These firms are focusing on modular platforms, open-source software integration, and expanding into emerging markets through strategic alliances and acquisitions.

Segmentation Growth

Segment-level analysis reveals several key trends. On the basis of type, micro-UAVs commanded the majority share in 2022 (approx. 70%), due to their light weight, cost-efficiency and utility in confined or risky environments. On application, the civil/commercial category held around 65% of the 2022 market, driven by sectors such as agriculture, surveying, inspection and logistics. On platform, rotary-wing drones dominated with about 59% share in 2022, since their vertical take-off and landing capability makes them ideal for many commercial and defense missions. Regionally, North America is the largest market at present, with Europe trailing, and Asia-Pacific expected to show the fastest growth — propelled by China and India.

Conclusion

The small UAV market is expanding beyond early adopters into substantial commercial and military applications. Enterprises that align with evolving regulations, leverage strong partnerships and deliver cost-effective, scalable drone solutions stand to gain significantly as this market grows. With estimated five-fold growth by 2035, now is the time to engage.

Related Report: